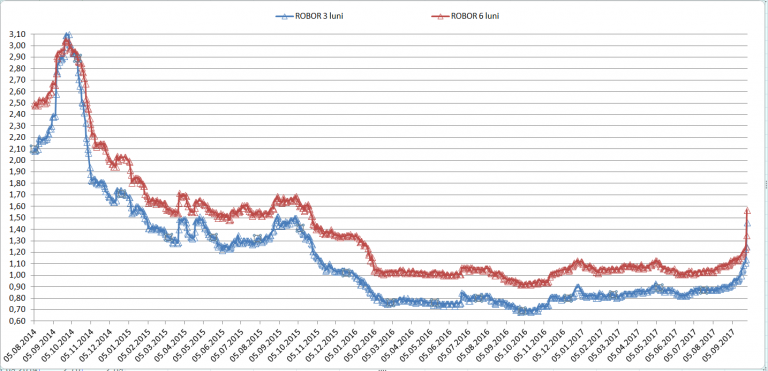

Interest rates on the interbank market (ROBOR) recorded this week the fastest growth in the past three years after banks’ expectations have led to a decline in liquidity on the market.

Interest rates on the interbank market (ROBOR) recorded this week the fastest growth in the past three years after banks’ expectations have led to a decline in liquidity on the market.

However, the temporary drop in liquidity on the money market has fundamental causes, and even if sudden market movements are usually corrected by further developments, they will stabilize at higher levels, observing a trend identified by Cursdeguvernare.ro even since this spring.

Banks’ expectations anticipate, on the one hand, that the National Bank of Romania (BNR) will tighten its monetary policy after revising upwards the inflation forecast, which supports the expectations regarding the BNR’s decisions.

On the other hand, the demand for lei in the market also comes from both the demand for loans and the Government’s financing need, amid the macroeconomic imbalances.

At the same time, the foreign exchange market seems blocked at a rate of less than RON 4.60/euro, a level that would discourage the sales of currency, according to market sources.

The National Bank has confirmed on Thursday that the interest rate trend was driven by the change in the market liquidity, which was severe enough to lead to an accelerated ROBOR increase. BNR says that the increase of the interest rate was something to be expected, although – of course, not in the current pace.

„The ROBOR evolution depends on the level of liquidity in the banking market. We are in a period of resetting this index after we had low interest rates at a historical level over the past period. From this perspective, this growth was expected to start,” stated on Thursday Dan Suciu, the BNR spokesman.

Indeed, the reversal of the interest rate trend has been confirmed since the spring, when the 3-month ROBOR average interbank rate went for the first time above the temporary equilibrium range set between 0.8% and 0.9%, where it has stayed since November last year, after exceeding the minimum historical levels.

Acceleration of interest rates

The 3-month ROBOR (Romanian Interbank Offered Rate) has increased on Thursday by more than 31.5% compared to Monday, to 1.46%/year and by 46% compared to the preceding Monday, when it exceeded the psychological threshold of 1%.

The 3-month ROBOR is now the highest in exactly two years, it is more than double the level registered one year ago and 78% higher than at the beginning of 2017.

The 6-month ROBOR rose to 1.57% a year on Thursday, more than 27.6% above the level registered on Monday and by almost 54% this year, reaching the rate registered almost two years ago (October 15, 2015).

The 6-month ROBOR rose to 1.57% a year on Thursday, more than 27.6% above the level registered on Monday and by almost 54% this year, reaching the rate registered almost two years ago (October 15, 2015).

CFA Romania analysts expect the 3-month ROBOR to reach 1.67% on average in a year and inflation to reach 2.55%.

Market expectations

Based on the argument of the increasing inflationary pressures, bank analysts (and not only) expect that BNR will tighten the monetary policy and even increase the monetary policy interest rate from 1.75%/ year to 2-2.25% end of the year.

Banca Transilvania’s macroeconomic scenario says the BNR’s monetary policy rate could increase at least to 2% this year and to 3.5% in 2018.

„The acceleration of the domestic economy in the first half of this year seems unsustainable given the intensification of the macroeconomic imbalances and the persistence of a difficult investment environment,” said Andrei Radulescu, Senior Economist at BT, in a report issued on Thursday.

At the same time, „in the financial economy domain, the domestic market failed to accompany the positive global climate, amid the signals about a more aggressive state intervention in the economy, as well as the increasing risks to mid-term macro-financial stability,” adds the economist quoted.

„The central bank will increase its monetary policy rate by the end of this year, as well as during the next year, close to the inflation target (2.5%),” said Iancu Guda, President of the Association of Financial and Banking Analysts of Romania (AAFBR).

BNR revised the inflation forecast from 1.6% to 1.9% for the end of this year and from 3.1% to 3.2% for the end of 2018.

„Inflation is increasing, and it is absolutely clear that interest rates will increase, and will be normally above the inflation rate, although they will stay for a time below it, depending on the pace adaptation,” said on Monday Ionut Dumitru, Chief Economist of Raiffeisen Bank, for Cursdeguvernare.ro.

„Recent interest rate changes are a consequence of the level of liquidity in the market and the transactions with this liquidity,” said also on Monday Florian Libocor, Chief Economist of BRD, in a personal capacity.

Economist Aurelian Dochia, in his turn, also considered that „the increase in the interest rates was something to be expected, on the one hand, because inflation is increasing, as well as the demand for loans, the growth of which also pushes upward the interests. On the other hand, let’s not forget that the big central banks are on the trajectory of normalizing the monetary policy (the FED gave clear indications, and the ECB is to follow). ”

For now, it is expected that BNR will raise the interest on the deposit facility offered to the banks in its Tuesday meeting, as Erste Group Research estimated.

The cost of financing the companies, the state and the debt burden of indebted individuals will significantly increase but the growth will be felt at the end of the year, as banks include the ROBOR growth as a quarterly average.

Depending on the type of loan, estimates of the increase in the monthly reimbursement rates start from a few lei per month for the consumer credit of 5,000 euros on five years and reach almost 1,000 lei for a corporate loan of one million euros, at the current ROBOR level.

For now, borrowers who have contracted loans after November 2015 are affected, which the BNR’s spokesman did not hesitate to notice, thus implicitly confirming the trend of increasing the interest rate.