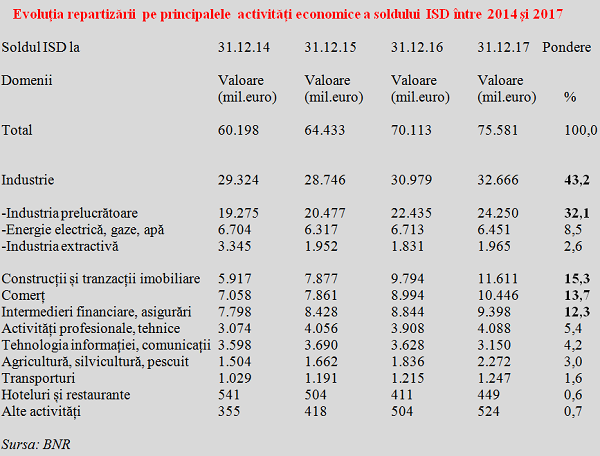

The balance of foreign direct investment (FDI) in the Romanian economy increased last year to EUR 75,581 million but declined in terms of GDP equivalent from slightly more than 41% of the annual GDP to 40.2%.

The balance of foreign direct investment (FDI) in the Romanian economy increased last year to EUR 75,581 million but declined in terms of GDP equivalent from slightly more than 41% of the annual GDP to 40.2%.

Centralized data published by the National Bank of Romania show that 69.5% of this amount (EUR 52,746 million) represented contribution to own capital (including reinvested profits) of foreign companies.

The rest of 30.5% was the net credit they received from abroad (EUR 23,105 million).

The net FDI flow over the last year was EUR 4,797 million, by slightly more than six percentage points above 2016. However, it is noteworthy to see important changes in the structure by components, where equity participations diminished by about 30% to EUR 2,235 million, while reinvested profit (and methodically assimilated to a foreign investment) increased by more than 50% to EUR 1,733 million.

It is worth noting the relatively high value of losses registered by a part of FDI enterprises in relation to the profits declared by FDI companies (EUR 2,809 million losses compared to EUR 8,068 million in profit, whereupon the reinvested amount resulted after a dividend distribution of EUR 3,526 million, according to BPM6 international methodology).

Related to a result of the FDI increase in all domains by about five and a half billion euros, new investments in the manufacturing sector amounted to about one third (EUR 1.81 billion). That is, just as it has been invested in the construction and real estate sector (which exceeded the threshold of 15% of the total), followed by trade (EUR 1.45 billion).

The financial and insurance sector remained far behind, with an amount slightly over half a billion euros. Electricity, gas, water production continued its oscillating trend on which it went round in circles in the last four years. At the same time, the significant drop in the foreign investment stock in IT&C is surprising (- EUR 478 million).

Within the manufacturing sector, the sectors that benefited from the highest foreign financing were the transport means (EUR 928 million), crude oil processing, chemicals, rubber and plastics (EUR 352 million) and metallurgy (EUR 242 million). It is noteworthy, though, that the manufacturing industry was below trade in terms of reinvested profits (EUR 650 million versus EUR 669 million).

*

- Evolution of the distribution of FDI balance by main sectors between 2014 -2017

- FDI balance at 31.12.14 31.12.15 31.12.16 31.12.17 share

- Sectors Value (million euros)

- Total

- Industry

- – Manufacturing

- – Electricity, natural gas, water

- – Extractive industry

- Construction and real estate

- Trade

- Financial intermediation and insurance

- Professional, technical activities

- IT&C

- Agriculture, forestry, fishery

- Transport

- Hotels and restaurants

- Other activities

*

Despite that we have a country with a remarkable touristic potential, statistical data on hotels and restaurant sector does not confirm that from the of foreign investors’ perspective as well. The share of this sector in total FDI remained totally derisory and the amounts invested, although slightly higher than last year, remained below 2014 and 2015.

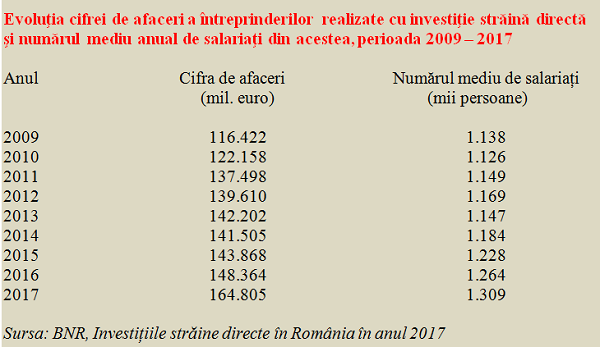

How productive activity of FDI companies evolved

The productive activity of foreign-owned companies has been increasing throughout the period 2009-2017, with the exception of a slight decrease in turnover in 2014 and a gradual decline in the number of employees in 2010. To be emphasized, the highest increase in the turnover of FDI enterprises over the past nine years was registered in 2017, and the number of employees exceeded the threshold of 1.3 million people.

*

- Turnover evolution in FDI companies and annual average number of employees, 2014-2017

- Year Turnover Average number of employees

*

Overall, net revenues earned by foreign direct investors in Romania last year amounted to EUR 5,877 million, up almost 16% compared to the previous year. They resulted from the net profits of EUR 5,259 million (+ 23%) and the net interest income from loans granted by parent companies to their companies in Romania, amounting to EUR 618 million (-21%).

It should also be mentioned the importance of FDI companies in terms of foreign trade, where they represented 73.4% of exports and 66.0% of imports, decreasing values compared to the previous year. These shares were larger but also balanced in the manufacturing sector, with 79.8% in export and 80.5% in import. The highs were achieved in the machinery and equipment segment (93.1% and 89.8%, respectively), strongly dominated by foreign capital.

In order to position ourselves in relation to the size of the economy, we mention that all in all, net revenues from foreign investments made in Romania accounted last year for 3.13% of GDP. Related to the accumulated balance of 40.2% of the same GDP, there is a remarkable profitability that should give us food for thought about the economic effects of up and down type.