The tensions hidden by Romania’s economic growth in 2016 (4.8%) are visible in the results of the 20 largest Romanian companies listed on the Bucharest Stock Exchange (BSE), according to their data reported to the stock exchange.

The tensions hidden by Romania’s economic growth in 2016 (4.8%) are visible in the results of the 20 largest Romanian companies listed on the Bucharest Stock Exchange (BSE), according to their data reported to the stock exchange.

The 2016 results of the companies from the BSE Top 20 „suggest that the economic growth was based mainly on consumption and investment with no speed,” said Mihai Purcarea, CEO of BRD Asset Management, for cursdeguvernare.ro.

The industrial companies have gained if they had a direct connection with the end consumer, such as OMV Petrom (SNP) through its gas stations network, which was not true for the energy companies such as Electrica (EL). SNP benefited from the increasing prices of its products, but Electrica – did not.

The banks had good results, but the corporate lending activity for investment has disappointed the analysts.

BRD has registered the highest profit growth compared to 2015. Banca Transilvania (TLV) had though a lower profit than in 2015 because of the costs that the absorption of another bank involved.

The TLV situation is the effect of an important trend in the banking sector: the system consolidation by a decrease in the number of players, with the opportunity cost of the decreasing profits.

The energy companies had, in their turn, a good fourth quarter of 2016 for their accounts, because it was cold. Otherwise, the industry demand has not helped them.

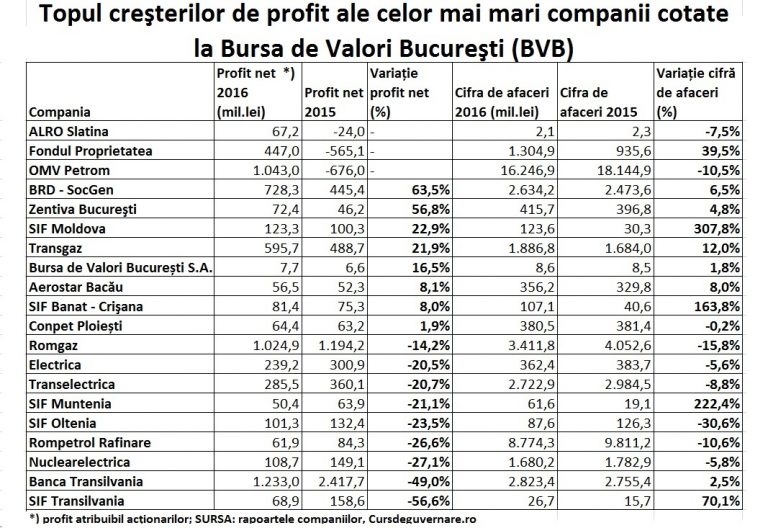

Ranking of largest listed companies by profit growth

Ranking of largest listed companies by profit growth

All 20 companies have posted profits in 2016. The profit in 2016 was higher than in 2015 for some of them and lower for others, but all profits have been obtained under stressful conditions of the business environment.

Banking system: growth generated by consumer loans, less by financing the economy

Two of the three largest banks in Romania in terms of asset size are listed on the BSE, which gives them a certain degree of representativeness for the sector.

„The results of the banks are perhaps the best illustration of the economic activity. They reported the improvement of their results, lower provisions and an increase in the lending activity, but especially due to the loans granted to individuals,” says Mihai Purcarea.

The signs shown by the banks’ results illustrate the main trends of the sector.

On one hand, the banks registered very good results, especially due to the outsourcing of non-performing loans and the increase in loans to population, not to companies.

BRD – SocGen (ticker symbol BRD) registered the highest growth of net profit among the top 20 most valuable listed companies: more than 63% in 2016 to over 728 million lei.

Banca Transilvania (TLV) has successfully absorbed Volksbank Romania and would have registered a performance comparable to BRD without the costs of integrating the non-performing loans of the other bank. The net profit of Banca Transilvania (TLV) decreased by 49% in 2016 to over 1.23 billion lei.

In the same series of banking system consolidation through mergers is the takeover of the third bank listed on BSE, Banca Comerciala Carpatica (BCC) by Patria Bank, an apparently smaller bank, but not having the problems of the absorbed bank.

„On the other hand, the loans to companies (editor’s note – granted by banks) still have a disappointing evolution,” says the director of BRD AM.

The low level of commercial lending does not give good signals on the Romanian economy, nor on the companies, whether the banks are afraid to lend money because of the risks or the companies fear to go into debt, as they are distrustful about their future profits.

About 57% of the companies from Romania would not take out a loan in lei, while 62% of the companies would not take out a loan in euros regardless of the cost, according to a survey run last year by the National Bank of Romania.

BRD and TLV are the largest banks in Romania after BCR by asset size.

Energy: profit obtained due to cold weather, not industrial consumption

On the one hand, two industrial companies returned to profit in 2016: OMV Petrom (SNP) and the producer of primary aluminium Alro Slatina (ALR).

Companies that also registered a double-digit profit growth in 2016 compared to 2015: pharmaceutical producer Zentiva Bucharest (SCD) – a profit of almost 57% higher, up to over 72 million lei and Transgaz (TGN) – 22 % increase to almost 596 million lei.

On the other hand, the profits of energy companies and energy service companies were lower in 2016 than in 2015, except Transgaz.

The evolution of the energy companies has been favourably influenced by the cold weather from the last quarter of 2016, but not by the increase in the industrial demand. The transport volumes on the national high voltage buses remained „relatively stable” in 2016, even though the household consumption has increased.

„The evolution of OMV Petrom (SNP) remains rather a function of oil price that has stabilized for the moment at over 50 USD/barrel. A heavier winter than expected has added to this, which pushed the energy prices up. Consequently, Petrom successfully benefits in 2016 from the upturn of the hydrocarbons and reports a (preliminary) unadjusted net profit of 1.04 billion lei, compared to a 0.67 billion lei loss in 2015,” writes Ovidiu Dumitrescu, Deputy General Director of the brokerage firm Tradeville in his answer to the request of cursdeguvernare.ro.

In the same time, „a higher retail demand in Romania improved the performance of Petrom downstream segment, although the refining margin, which decreased (regionally), would have indicated a much worse performance,” said Mihai Purcarea, the director of BRD Asset Management.

Incidentally, the CEO of Petrom, Mariana Gheorghe, warned that „in 2016, the market environment remained volatile and difficult, which resulted in the EBIT decrease (operating profit, editor’s note) that annulled the benefits achieved by continuing the strict cost management”.

In their turn, “Romgaz (SNG) and Nuclearelectrica (SNN) benefited from the cold weather that caused a substantial increase in natural gas and electricity consumption” at the end of the year, says Ovidiu Dumitrescu.

„Last quarter of 2016 brought a strong return (of Romgaz profit, editor’s note), as the net profit increased by 42% compared to the same period of 2015 and the positive trend is likely to continue in Q1/2017,” notes the Director of Tradeville.

However, the benefits from the cold weather were not enough for the net profit of Romgaz (SNG) to avoid the decrease of 14.2%, to 1.025 billion lei in 2016.

Also, the cold weather was not decisive for Nuclearelectrica (SNN) either. SNN „reported the decrease of the operating revenue by 5.7% compared to 2015 and the amount of electricity sold decreased because of the prolonged works in its reactor 1. The operating profit slightly decreased by 1.2%, but the financial loss caused by the local currency depreciation led to a decrease of over 27% in net profit,” says Ovidiu Dumitrescu.

And Transgaz (TGN), the national operator of gas pipelines, benefited from the threat of cold weather and registered a net profit of 237 million lei in the last quarter of 2016, out of a total of 596 million lei in the whole year. It was not about the increase of the transport volume, but rather the increase of bills for the reservation of the transport capacity due to the perspective of a heavier winter, notes a report by BT Capital Partners.

„The higher profits of TGN mainly come from the capacity reservation; most likely they are all importers who want to avoid short-term imports, which are more expensive,” says Mihai Purcarea from BRD Asset Management.

Transelectrica (TEL), another company operating a state monopoly (electricity transportation through national high voltage buses), saw its profit down by nearly 21% to nearly 286 million lei, „following the impact of the reduction that ANRE applied for the average tariffs of energy transportation (…), given a relatively stable volume of electricity transported (about 43.7 TWh, -0.2% y/y). In addition, the revenue from the allocation of the interconnection capacity has also decreased (-19.5% y/y) due to the decrease in the exported/imported volumes and the return to traders of the revenues from reselling the paid and unused capacity,” said another report of BT Capital Partners.

„The deteriorating results of the utility companies also show a tariff reduction applied by ANRE, under the current regulations. In some cases of companies such as Romgaz, it also indicates a weak management, subject to the external pressures of the company. Romgaz has consequently lost market share to imports. In other cases, such as Electrica, the cause should be attributed to a weaker risk management „, said Mihai Purcarea from BRD Asset Management.

Electrica (EL), the largest electricity provider and distributor in Romania, reported a preliminary net profit of 239 million lei, down by 20% as compared to 2015 (300 mln lei). The same as in 2015, though, the net profit has been generated by the net financial revenue of nearly 388 million lei and not the operating revenue that was negative. The financial revenue includes the revenue from the operations risk management.

Season of dividends: State collects almost all profits of its companies

With the publication of the preliminary results for 2016, the dividend season officially starts at the Bucharest Stock Exchange (BSE), where the investors’ activity is firstly driven by their interest in dividends. Otherwise, the shares are largely hoarded and there are few opportunities for speculation.

The same as before, the season of dividends will be animated this year especially by the profit allocations of the state companies, which have just been increased to 90% of their profits.

*

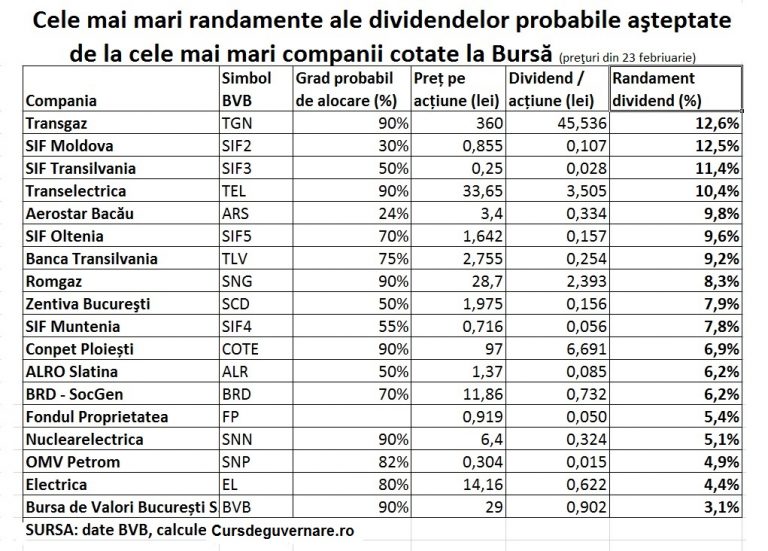

- The highest yields of probable dividend foreseen for the largest listed companies

- Company ticker symbol probable allocation rate share price dividend/share dividend yield

- Source: BSE, own calculations

*

„At least in the short term, investors put aside their worries about the lack of investment (in utility companies, editor’s note) and the unfavourable regulatory framework, as they are attracted by the perspective of some generous dividend distribution„, considers Georgiana Androne, Investment Analyst at Tradeville.

Throughout the dividends season, investors estimate the rate of profit allocation for dividends, obtain an expected value of the gross dividend and calculate the gross dividend yield in relation to the market price. The higher the dividend yield compared to the interest rate, the more attractive is the respective share.

The financial investment companies (SIF) and Fondul Proprietatea have been maintained in BSE TOP 20 because they are sought after by investors, even though the relevance of their results comes down to the size of the dividends that the companies from their portfolios pay in 2016. Dividends have been allocated from the 2015 profits.

SIFs and FP comprise several not listed companies (BCR, Hidroelectrica, the Romanian Lottery, Salrom).

BSE TOP 20

Eleven of the BSE Top 20 companies registered net profit increases last year compared to 2015. Moreover, three of the 11 best companies have returned to profit in 2016: OMV Petrom (ticker symbol SNP), Alro Slatina (ALR) and Fondul Proprietatea (FP).

Some of the 11 companies do not have any direct connection with the retail sector or the final consumer, which is a sign that the Romanian economy has grown due to other causes than the wage increases for the state employees or the VAT cut.

Of the companies that registered lower profit in 2016 than in 2015, Banca Transilvania (TLV) group stands out. If excluding the gain from acquisitions in 2015, the 2016 net profit change is positive, 61%, compared to the previous year.

The signals of the 2016 results of the listed companies are valid given that the „main stock indices are dominated by the energy or public utility companies, which reflect only partially the economic developments,” mentions the Director of BRD Asset Management.

It is true, there are some key companies for the Romanian economy missing from the stock exchange (Automobile Dacia, Hidroelectrica, Arcelor Mittal Romania, BCR). The major foreign retail companies are also missing from the BSE and they are in the top largest companies in Romania by turnover and took advantage from the wage increases and last year’s fiscal loosening.