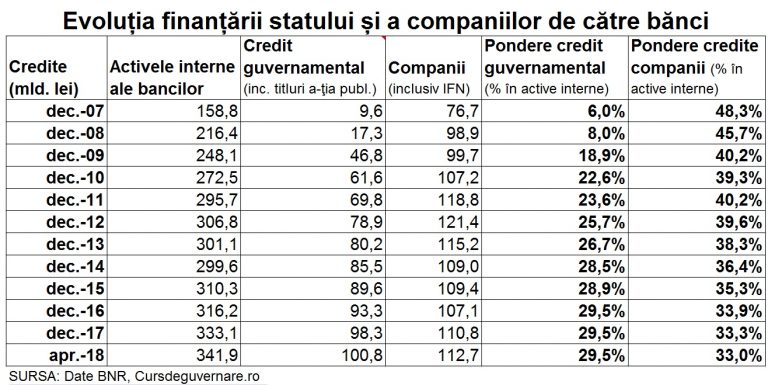

The volume of government credit has increased about 10 times over the last 10 years, and the share in total banking investment in Romania has increased almost 5 times, according to data from the National Bank of Romania (BNR).

Instead, the share of corporate loans declined from 48% in 2007 to 33% in April 2018 in total internal bank assets.

Banks have a „significant sovereign exposure” also according to the National Bank of Romania report issued in June 2018, which places the exposure among the top five in the European Union.

For its part, the International Monetary Fund (IMF) believes that „banks’ holdings of Romanian sovereign debt have increased very much, exposing them to valuation losses in the event of a rise in interest rates or sovereign risk,” according to the FSAP evaluation report on the financial system, published in May.

Figures

*

- Evolution of bank financing of state and companies

- Loans (bn RON) internal bank assets government credit (including securities) companies (including IFNs) government credit share corporate credit share

*

The balance of government credit was RON 100.8 billion in April 2018, while in December 2007 it was barely RON 9.6 billion, „including the negotiable securities” issued by the central and local public administration.

The share of government credit (including securities) in the total bank internal assets has increased about 10 times, from 6% in 2007 to over 29% in April 2018. It also includes the claims against local public administration.

In contrast, non-government credit rose only 1.6 times in the same period, up to RON 238.4 billion, more on the population side (1.8 times, up to RON 125.7 billion) than for companies (1.5 times, up to RON 112.7 billion).

Banks’ exposure to the government is estimated by the BNR „around 22% of the aggregate asset over the past two years,” based on September 2017 data on government bonds and guarantees, according to BNR December financial stability report.

The banking sector owns about half of the public debt issued in the domestic market, according to June 2018 report, which does not change the proportion above.

Explanations

Information from several reports of the National Bank of Romania and independent analysts mainly identifies three types of causes of the increase in the share of government credit, namely the decline in the share of corporate loans:

- Few companies are bankable (whether they have negative equity or do not meet bank lending standards).

- Small companies’ appetite for bank loans. Commercial, shareholder and tax credits are preferred. This is amplified by the previously mentioned one.

- Lending to government and local administration is less risky than to companies, requires much less effort, and provides much more liquidity in the case of government bonds and municipal bonds.

On the other hand, the Government would have no cause for concern regarding the stability in financing its expenditure.

„The significant holdings of sovereign debt by credit institutions ensure, on the one hand, an increased degree of stability in the financing of the public sector, especially in the context of adverse developments in international and/or macroeconomic financial markets, and, on the other hand, an important source of liquidity for banks, which can reach the central bank’s resources if needed, by using these securities as collateral,” the BNR report said.

Nevertheless, the BNR recommends stepping up efforts to diversify the investor base, including by increasing public participation in public debt financing.”

Shortages

The low indebtedness capacity of Romanian companies makes them reach for bank loans only as a last resort, a phenomenon that is accentuated because of the rising interest rates.

„Companies mainly use financing from trade partners (23% of the aggregate liability), from shareholders (8.7%) or external creditors (6%), and they use to a lower extent loans from resident financial institutions (around 8% of the balance sheet liability), according to BNR 2017 report, based on 2016 data.

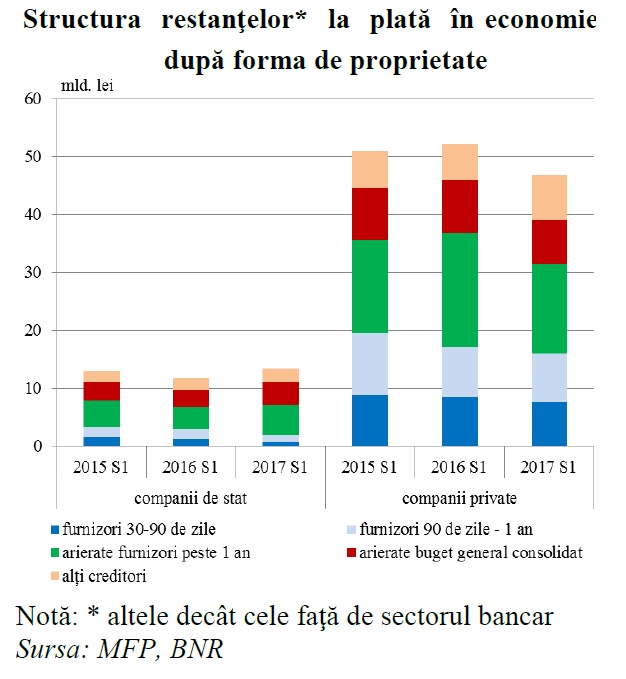

BNR report of June 2018 noted a 6% decrease in outstanding payments in the economy down to RON 60.3 billion in June 2017 compared to the same period of the previous year.

*

- Structure of due* payments in the economy by ownership

- State-owned companies private companies

- Suppliers 30-90 days suppliers 90 days – 1 year

- Arrears suppliers > 1 year Arrears of general consolidated budget

- Other creditors

- * Note – others than those to the banking sector

*

„These dynamics were mainly driven by the efforts of firms from the private sector to reduce arrears to both trade partners and the general consolidated budget. Unlike the private sector, the state-owned sector continued to increase its outstanding amounts.”

However, „suppliers’ arrears remain largely generated by private firms (81%), even though total savings in the economy to suppliers dropped to RON 38.7 billion (by RON 5 billion compared to the first half of 2016), while those with delays over one year decreased to RON 20.6 billion (down RON 2.9 billion compared to the same period).

Public sector companies continued to accumulate overdue payments of more than one year to suppliers (+ 39%, to RON 5.2 billion), even if they decreased those of less than one year.

The BNR notes the „uneven evolutions of financial intermediation at the sector level” and finds the causes in:

- the low capitalization level for a large number of companies,

- the lax payment discipline and deficiencies of the insolvency procedure for legal entities, but also in

- the lack of financing products that address companies’ specific needs in terms of supply

- the skill level of banking staff involved in the lending activity.

*

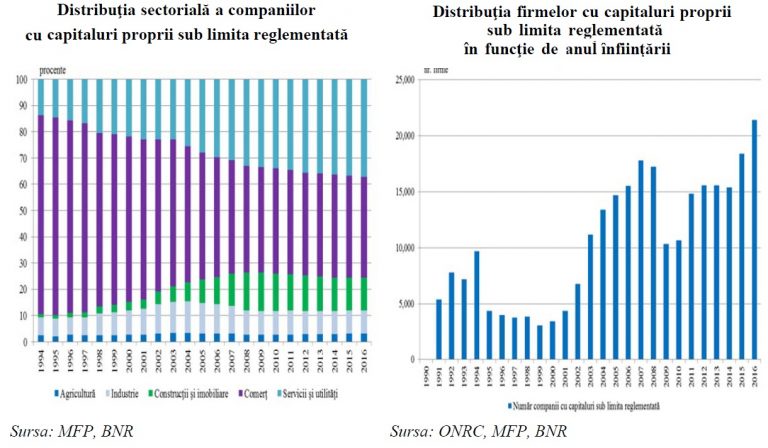

- Sector structure of companies with own capital below legal threshold Structure of companies with own capital below the legal threshold by year of establishment

*

About 42% of the companies had a negative own capital in 2016 and over 276,000 companies (44% of the total in 2016) had an own capital of less than 50% of the share capital, below the threshold set by the updated Law 31/1995.

On the other hand, 64% of those who could access loans attract a capital that more expensive than the returns obtained by the investment financed with this capital. In short, the effort is bigger than the effect, „says Iancu Guda, President of the Association of Financial-Banking Analysts, in a study on the 2008-2016 interval.

Vulnerabilities in the event of a crisis

Banks themselves would suffer because of too much exposure to government bonds, „in the event of a steep rise in interest rates combined with an (economic) growth shock comparable to that of the 2008 crisis,” according to the IMF FSAP report.

The IMF report indicates that „some of the 12 banks subject to stress tests could not meet the minimum threshold for capital adequacy ratio 1 (CET1).

Banks’ capital would be „significantly” affected. „Stress tests indicate a capital loss of 9 percentage points over a three-year period as a result of the trading losses on the portfolio of government securities and on the credit portfolio.”

The CET1 ratio for the 12 banks analysed would drop from 17.1% at the end of 2017 to 8.2% at the end of 2020, according to the negative scenario. Also, the ratio between the capital and total assets would decrease from 9.3% to 4.8% over the same period.

And, of course, banks’ difficulties would also attract the difficulty in companies’ access to lending.