Foreign direct investment (FDI) in Romania reached EUR 64,433 million last year, equivalent to 40% of annual GDP.

Foreign direct investment (FDI) in Romania reached EUR 64,433 million last year, equivalent to 40% of annual GDP.

Centralized BNR data shows that 70% of this amount (EUR45,098 million) was contribution to the equity (including reinvested earnings) of foreign firms. The remaining 30% represented the net credit received from abroad (EUR19,335 million).

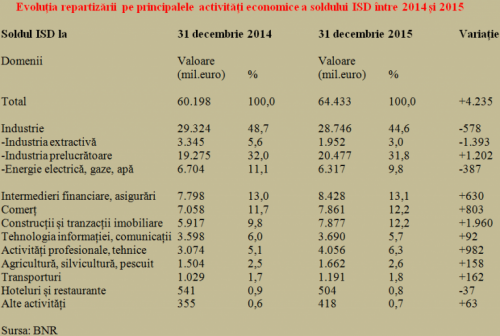

This is the result of the overall FDI increase in all fields of activity by more than four billion euros, while construction and real estate have gained nearly half of this increase (+ EUR 1.96 billion).

Noteworthy is that new investment in manufacturing (+ EUR1.2 billion) have surpassed investment in trade (EUR 0.8 billion).

*

- FDI structure evolution by main economic activities between 2014-2015

- FDI stock as at 31 December 2014 as at 31 December 2015 Change

- Activity Amount (MEUR)

- Industry, of which:

- – Extractive industry

- – Manufacturing

- – Electricity, natural gas, water

- Financial intermediation and insurance

- Trade

- Construction and real estate

- IT&C

- Professional and technical activities

- Transportation

- Hotels and restaurants

- Other activities

- Source: BNR

*

Professional and technical activities represented a point of obvious interest for the foreign investors and contributed almost one billion euros, which is not bad at all if we consider our target to develop higher added value sectors. Somewhat surprisingly, the IT segment’s position has plus of only 92 million, which could raise questions.

Contrary to the public rhetoric and idea that we have a country with a remarkable tourist potential, the hotels and restaurants segment shows a minus EUR 37 million compared to the previous year.

To which much larger negative amounts are added from the extractive industry (about EUR -1.4 billion ?!) and electricity, natural gas and water (with a declining trend toward about EUR 400 million).

To bear in mind, the tangible and intangible assets advanced between 2014 and 2015 by only EUR 87 million, from EUR 30,883 million to 30,970 million. As a result, it turned from a majority to a minority contribution to FDI (from 51.3% to 48.1 %). That indicates a certain decrease of the FDI stability.

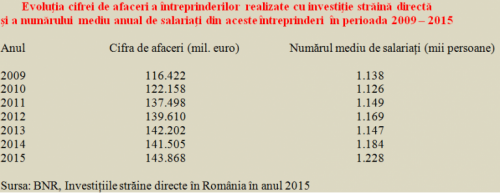

Evolution of productive activity of the FDI companies

The productive activity of the companies with foreign capital has been increasing throughout the period 2009 – 2015, except for a slight turnover decrease in 2014 and a temporary decrease of employed in 2010 (see table). Moreover, 2015 marked the point of crossing the threshold of 1.2 million people who found work in the FDI enterprises.

*

- Evolution of the FDI enterprises’ turnover and average annual number of employees between 2009-2015

- Year Turnover (MEUR) Average number of employees (thousand persons)

- Source: BNR, FDI in Romania in 2015

*

Overall, foreign direct investors in Romania obtained net income last year amounted to EUR 3,746 million. The amount is the result of EUR 6,038 million profits, less the reported losses worth EUR 3,129 million (balance of EUR 2,909 million). It should be mentioned that dividends distributed to foreign investors amounted to EUR 2,399 million and EUR 510 million represents the reinvested profit.

Net interest income amounting to EUR 837 million paid on loans granted by parent firms to their enterprises in Romania added to the balance of approximately EUR 2,9 billion.

Related to the size of the economy, we note that, on the whole, net income by foreign investment in Romania represented in 2015 approximately 2.2% of GDP.

Finally, we should also mention the importance of the FDI enterprises in terms of foreign trade, as they contributed 69.4% of total exports and 62.8% of the imports (and even more, 77.8% of exports and 77.1% of imports in the manufacturing industry). It should be noted the reverse of this ratio in the services segment (55.1% to 56.9%) and, especially, in trade (35.2% to 47.8% of the total for this sector).