Romania is captive of tax and wage policies that are hostile to long-term sustainable development.

Romania is captive of tax and wage policies that are hostile to long-term sustainable development.

One of the most striking arguments is the very large amplitude of GDP deviations from the potential, resulting from a pro-cyclical policy which reduces taxation, although it would not be needed as the economic growth is already high, according to a study by economist Ionut Dumitru.

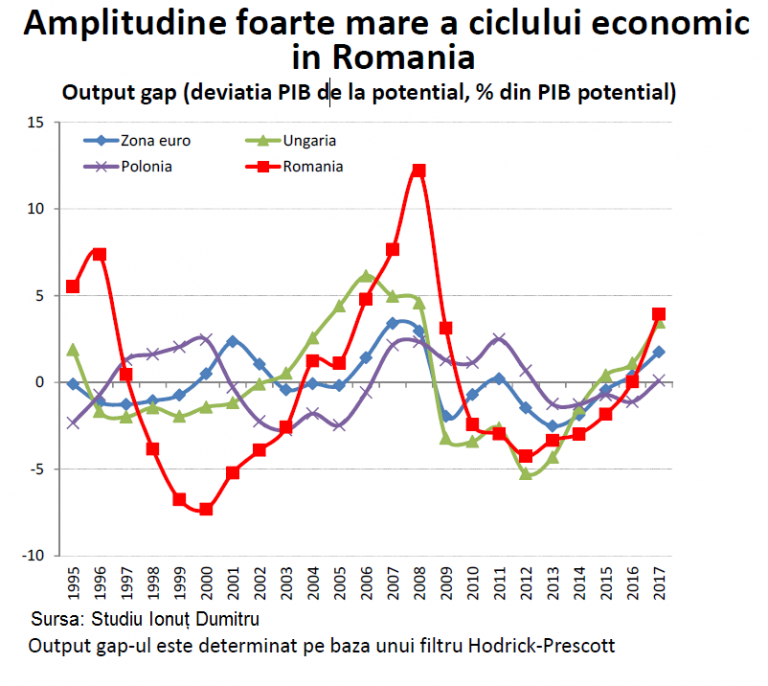

The „output gap” indicator (GDP deviation from the potential) is the furthest from the potential in Romania, unlike Poland, Hungary and the Eurozone.

In 2008, which preceded the crisis, the GDP growth deviation from the real potential of the economy was more than double in Romania compared to Hungary and about six times higher than in Poland.

„The amplitude of the economic cycle is very high in Romania,” and „the discretionary fiscal policy exacerbates the fluctuations of the economic cycle,” says Ionut Dumitru.

- Very high amplitude of the economic cycle in Romania

- Output gap indicator (GDP deviation from the potential)

*

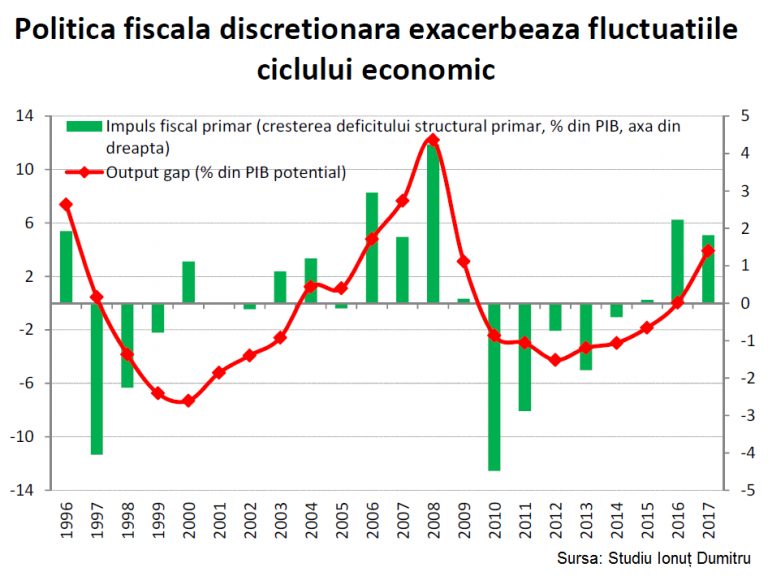

Basically, the Government repeats the pro-cyclical policy errors of that year (reduction of taxation when the economy was growing anyway even without this incentive), with the political support of a parliamentary majority that refuses the dialogue based on arguments.

Because of the pro-cyclical tax policy during (still) the ascending phase of the economic cycle:

- „The discretionary fiscal inventive is maintained although it should have been withdrawn.

- the available fiscal space is utilized unnecessarily and macroeconomic imbalances occur.

- It accentuates the economic boom phase,” says Ionut Dumitru’s study.

In the downward phase, it will be seen that:

- „There were not enough” buffers „created in good times and the fiscal space has been exhausted at that time.

- the implementation of pro-cyclical policies during the ascendant phase does not leave the option of a counter-cyclical policy in the downward phase.

- (pro-cyclical policy) accentuates recession.”

- Discretionary fiscal policy exacerbates fluctuations of the economic cycle

- Primary fiscal impulse (the increase of the structural primary deficit, share of GDP, the axis on the right side)

- Output gap (% of potential GDP)

*

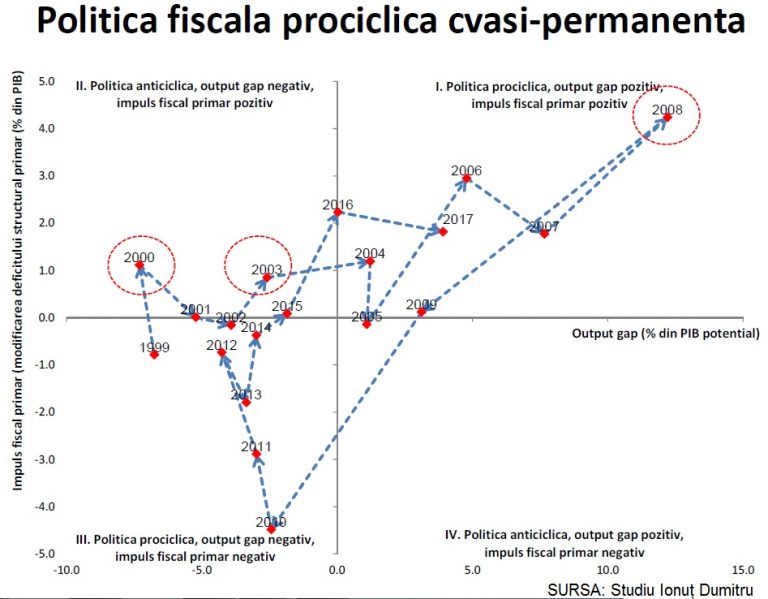

In Romania, a „quasi-permanent pro-cyclical fiscal policy” has been adopted over the last 20 years, according to the study mentioned, „Aspects regarding the fiscal-budgetary policy – economic growth relationship”.

*

- Quasi-permanent pro-cyclical fiscal policy

*

Anti-cyclical policy, negative output gap, positive fiscal primary impulse Pro-cyclical policy, positive output gap, positive fiscal primary impulse Pro-cyclical policy, negative output gap, negative fiscal primary impulse Anti-cyclical policy, positive output gap, negative fiscal primary impulse

„Anti-cyclical fiscal policy stimulates the economic growth and pro-cyclical fiscal policy inhibits long-term economic growth, especially in countries with low financial intermediation,” says Ionut Dumitru.

Revenge of real economy to come

„Romania has a high budget deficit today, accompanied by a (significant) increase in inflation and an increase in the external deficit (twin deficits),” said Ionut Dumitru.

The actual budget deficit (ESA 2010) was for two years at the maximum threshold of the EU Treaty and will continue to be 3% over the next two years, and the structural budget deficit (3% of GDP in 2016) increased to 4.3% last year and will deepen to 5.2% this year and to 5.8% next year, according to the estimates of the economist mentioned

*

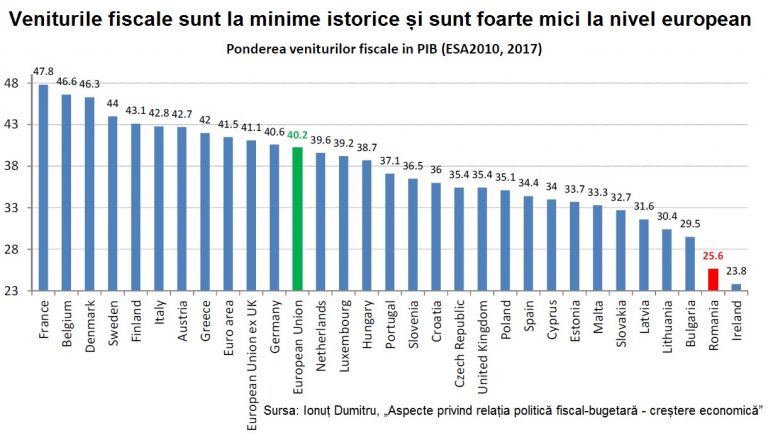

- Tax revenues are at historically minimum levels and very low at the European level

- Tac revenue share of GDP

*

„A budget deficit of 3% of GDP is far too high for the economic cycle that we are in and makes us vulnerable (by exhausting the fiscal space) to a future downward phase of the economic cycle,” the study said.

Besides, the structure of budget revenues has become more unfriendly over the last years to the long-term economic growth.

And the Romanian Government’s tax revenues are the lowest as a share of GDP in the European Union, except for Ireland.

*

*