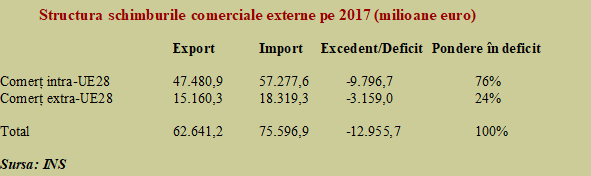

The trade deficit was EUR 12,955.7 million in 2017, 30% higher than in the previous year.

The trade deficit was EUR 12,955.7 million in 2017, 30% higher than in the previous year.

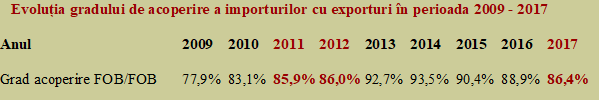

Despite a more robust economic growth, the import coverage ratio by exports dropped to just 86.4%, almost at the level of the crisis years 2011-2012, after four years of a systematically worsening.

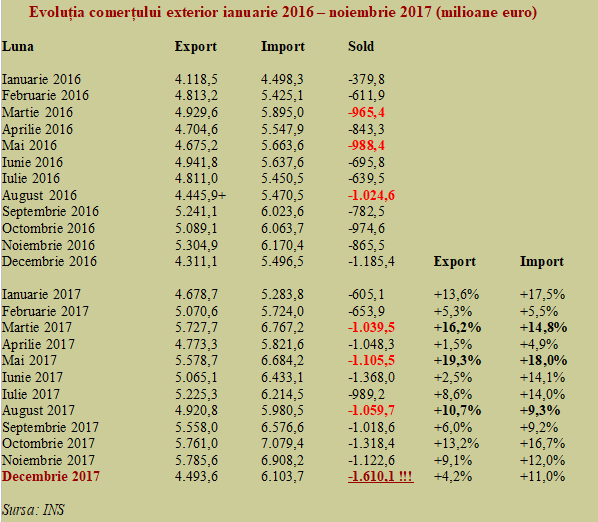

In December there was a record low in the negative result of the monthly foreign trade, which went up to over EUR 1.6 billion.

To keep in mind, the problem was not as much the high level of imports as the performance, the worst of all months of last year in terms of exports.

*

- Evolution of import coverage ratio by exports between 2009 and 2017

- Year

- Coverage ratio FOB/FOB

*

Last year, imports continued to grow at a significantly higher rate than exports (12.2% versus 9.1% in euro).

The trade deficit threshold of 13 billion was avoided by a whisker, after imports fell by almost one billion euros in December 2017 compared to October and November.

The updated (based on recalculated values) situation of the past 24 months, to see the changes in every month over the same month of the previous year, is as follows:

*

- Evolution of foreign trade January 2016- November 2017 (million euros)

- Month Export Import Balance

*

As we can see, only in March, May and August 2017 the growth rate of exports was above rate of imports. But the winning score was so tight that the trade deficit continued to increase even in these cases. In other words, we need not just a higher growth rate of exports vs. imports but a much higher rate, to try to reduce the chronic deficit of foreign trade for goods.

By putting the value of the negative trade balance in relation to the preliminary GDP for the current year (EUR 186.77 billion at the average exchange rate of 4.5681 lei/euro) we obtain a worrying negative result for the foreign trade of almost 7% of GDP. It was therefore as clear as possible how the domestic production proved unable to keep the pace with the rising incomes of the population.

Situation by large destinations and sectoral structure

Trade exchanges with EU countries accounted for about EUR 47.48 billion in exports and EUR 57.28 billion euro in imports (76% of the total both for exports and imports). On the non-EU trade side, exports amounted to EUR 15.16 billion and imports to EUR 18.32 billion (24% of the total both for exports and imports). In other words, our external competitiveness is equally suffering in relation to both the EU and the non-EU states.

*

- Structure of foreign trade in 2017 (million euros)

- Export Import Surplus/deficit Share of deficit

- Intra-EU 28 trade

- Non-EU 28 trade

*

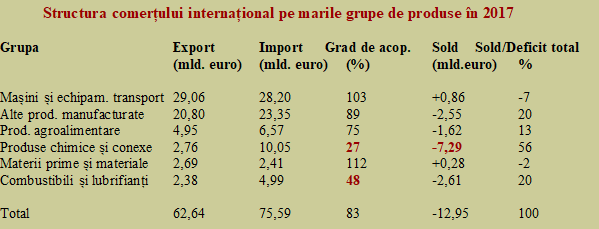

By structure, Romania achieved a positive sectoral result in the transport machinery and equipment segment (+EUR 0.86 billion).

This result was, though, weaker by more than one third compared to 2016 (+EUR1.36 billion) and its capacity to partially cover the overall negative result of the foreign trade halved, from 14% to 7% of the balance.

*

- Structure of foreign trade by main groups of products, in 2017

- Transport machinery and equipment

- Other manufactured products

- Agri-food products

- Chemicals and related products

- Raw materials

- Fuels and lubricants

*

The situation has significantly worsened over last year in a sector where we had years ago comparative advantages and were net exporters, namely fuels and lubricants, where the import coverage by exports went down to a disastrous 48% (we massively import fuels from countries like Bulgaria and Hungary, which have neither own resources nor tradition in the field).

For chemicals and related products, the situation is even worse, with a sectoral coverage decreased to only 27%. By its own, this sector (where we massively dismantled the production capacities we had before 1989) produced four-sevenths of Romania’s trade deficit.

If we add the similar deficit resulting from trade exchanges of other manufactured products than transport machinery and equipment (what if we did not have this strength, hardly built in the years of planned industrialization and accidentally taken over through some privatizations made with more sense of responsibility?) we get the full picture of a country that obtains a small surplus of no benefit, with raw materials, instead of processing them locally and selling them on foreign markets (or cutting from the imports of products made by others).

We are doing our duty and reiterate that Romania should quickly find a solution to balance the trade that started an increasingly unfavourable trend. Although we have almost the same industry share in the economy as Germans, they obtain a foreign trade balance of + 7% of GDP and we have -7% of GDP. But, beyond the fact that they did not abandon the petrochemicals sector, what added value do they sell and what added value do we sell?