The rise in interest rates and fees is becoming increasingly worrying for companies and maintains companies’ aversion to banking lending at high levels, according to the most recent semi-annual survey by the National Bank of Romania (BNR) on the access to financing.

The rise in interest rates and fees is becoming increasingly worrying for companies and maintains companies’ aversion to banking lending at high levels, according to the most recent semi-annual survey by the National Bank of Romania (BNR) on the access to financing.

The other major, increasing difficulties in accessing a bank loan (or from an IFN) are:

- requirements on the value or type of collateral

- contractual clauses

- bureaucracy

The proportion of companies that consider the level of interest rates and fees is too high and this is „a major difficulty in accessing a loan has increased by 9 percentage points,” according to the central bank’s survey.

„No banks” – the three-quarters of firms

„The products offered by banks and IFNs are not a priority for companies, except for the overstatement of bank accounts, for which 11% of the companies have opted for,” says the BNR study on the results of the survey.

*

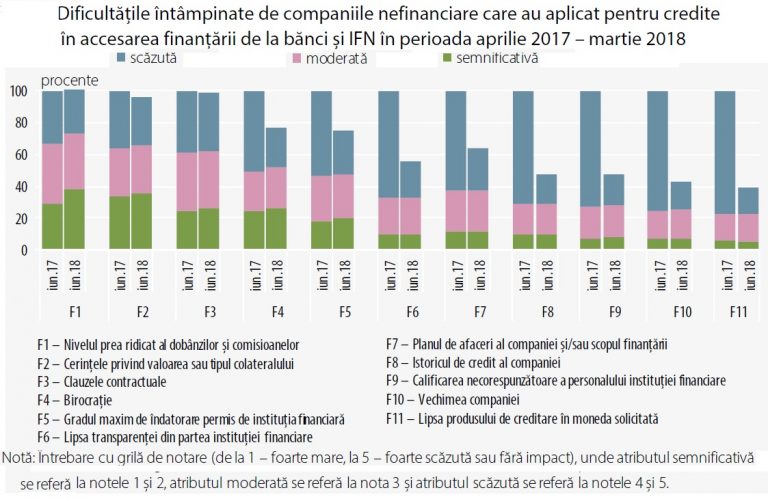

- Difficulties faced by non-financial companies that applied for loans in accessing financing from banks and IFNs between April 2017-March 2018

- Low Moderate Significant

- Percentages

- F1 – too high interest rates and fees

- F2 – requirements related to the value and type of collateral

- F3 – contractual clauses

- F4 – bureaucracy

- F5 – maximum indebtedness level allowed by the financial institution

- F6 – lack of transparency from the financial institution

- F7 – company’s business plan and the objective of the financing

- F8 – company’s credit history

- F9 – inadequate qualification of the financial institution’s personnel

- F 10- the age of the company

- F 11- lack of the credit product in the currency requested

- Note: closed questions with options weighted from 1- very high to 5 – very low or with no impact, where the “significant” attribute is assigned to levels 1 and 2, “moderate” to level 3, and “low” to 4 and 5.

*

„No banks” – motto for three-quarters of companies

„Products offered by banks and IFNs are not a priority for companies, except for the bank account overdraft, which was the option selected by 11% of the companies,” says the BNR study regarding the results.

The most preferred financing sources are:

- profit reinvestment or asset selling

- loans from shareholders or capital increases; and

- commercial credit

*

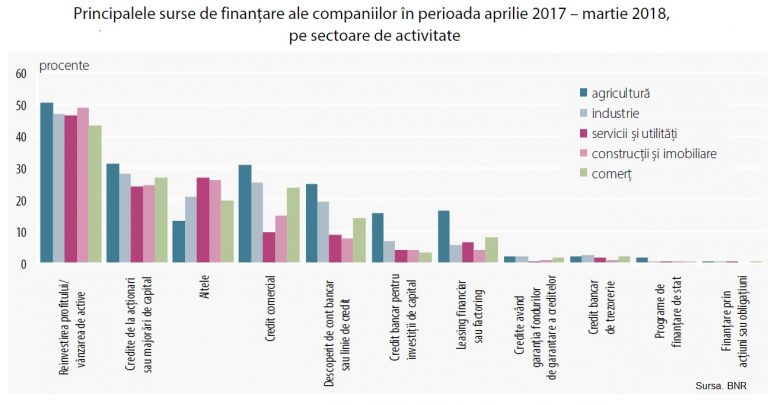

- Main financing sources for companies between April 2017 – March 2018, by fields of activity

- Agriculture

- Manufacturing

- Services and utilities

- Construction and real estate

- Trade

- profit reinvestment or asset selling loans from shareholders or capital increases other commercial credit bank account overdraft or credit line bank loan for capital investment financial leasing or factoring loans with guarantees from the guarantee funds treasury banking loan state financing program financing by shares or bonds

*

The availability for using banking or leasing products „has considerably declined” and „the availability for reinvesting profits or selling company assets has increased the most”.

The share of internal resources (including loans from shareholders) and commercial credits (namely, late payments) are still the most important financing means for companies.

Still, about 72% of companies do not have bank loans, and more than three quarters (78%) of companies have not used loans from banks or IFNs over the past 12 months surveyed.

Percentages are considered very high, even though the share of companies that did not apply for loans is slightly lower than the survey published in December (85%). The current BNR survey covers the period April 2017-March 2018.

*

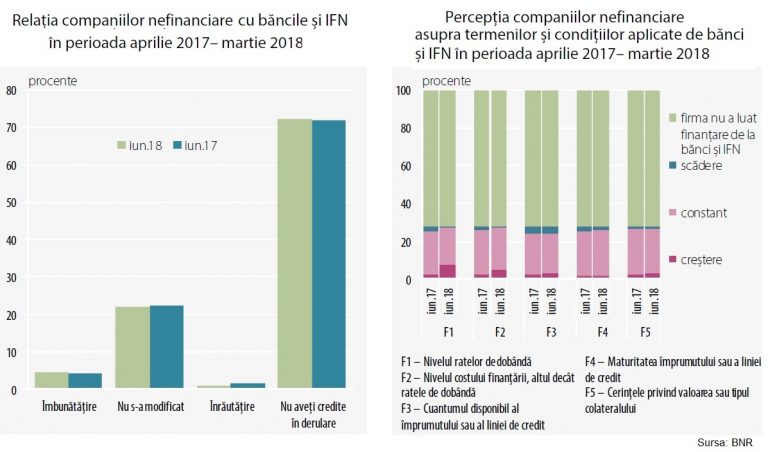

- Relationship of non-financial companies with banks and IFNs in the period April 2017-March 2018

- Percentages

- June 2018 June 2017

- Improvement Not changed Worsened don’t have loans under implementation

- Perceptions of non-financial companies on terms and conditions applied by banks and IFNs between April 2017-March 2018

- Percentages

- The company has not used financing from banks and IFNs

- Decrease

- Constant

- Increase

- F1 – level of interest rates

- F2 – level of the financing cost, other than the interest rates

- F3 – amount available of the loan or credit line

- F4 – maturity of loan or credit line

- F5 – requirements on the value and type of collateral

*

„This behaviour, regarding a low appetite for banking or IFN lending, defines especially SMEs (78%), while the proportion for corporations is around 51%,” says the BNR study.

Only 28% of the 11,000 firms surveyed „applied for financing from banks/IFNs and used these funds for establishing a working capital or paying suppliers”.