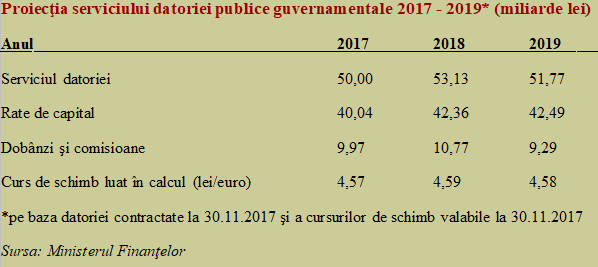

Romania will pay more than RON 10 billion in 2018 only for interest and fees on foreign debt, according to the Ministry of Finance’s forecast of the government public debt service.

Romania will pay more than RON 10 billion in 2018 only for interest and fees on foreign debt, according to the Ministry of Finance’s forecast of the government public debt service.

The situation was valid before the last month of 2017, but in the meantime, the obligations could have been increased based on other amounts borrowed.

In relation to the GDP value of RON 924 billion, advanced by the National Prognosis Commission for the current year, it means that we will pay at least 1.17% of GDP as a result of a debt accumulated by the Romanian state, worth about 38% GDP.

In other words, we should pay a „fee” of 3% only to maintain the public debt at the same level.

At the same time, we will have to „roll over” (read getting funding to replace the amounts outstanding in 2018, which we do not even intend to, and cannot pay from a budget with revenues of RON 287.5 billion) debts of over RON 42 billion.

And so, if we calculate by relating to budget revenues, just for interest and fees, almost four percent of the money collected from taxpayers will be paid for some money borrowed in the past and used a long time ago. Plus, the short-term obligations that have been undertaken for what we contracted since December 2017.

*

- Forecast of the government public debt service 2017-2019 (billion lei)

- Year

- Debt service

- Capital ratios

- Interest and fees

- Exchange rate considered (lei/euro)

- *based on the debt incurred, at November 30, 2017, and exchange rates at November 30, 2017

*

While the amounts attracted from the domestic market remain somewhere below the threshold of RON 50 billion, the amount planned to be raised from the foreign market is about EUR 5 billion. Convertible to the domestic currency later, when the maturity of the payment in Romanian lei is reached, at the exchange rate at that time. It is interesting that the debt service forecast has been made at an average exchange rate of only 4.59 lei/euro for 2018, down to 4.58 lei/euro in 2019 and estimated (quite optimistically, if we look at the foreign exchange market now) at only 4.54 lei/euro for the interval 2021 – 2024.

Why is that interval interesting? Because for the mid and long-term euro-denominated debt, the reimbursement will be made by collecting taxes in lei at an exchange rate valid after years, when the time comes to give the money back or to borrow new amounts in euro, to reimburse it.

It should be also noticed that the space for contracting new amounts due in 2019 is quite over if we compare to 2018. That is, we should be careful about the objectives for which we get new loans and the potential spike of indebtedness to the threshold of 40% of GDP if the expected GDP does not materialize.

Which raises some questions. 6.1% real GDP growth, which became 5.5% but 0.2% would have been gone (according to the CNP) only from the mandatory first increase in the monetary policy rate, which remained far behind the level reached by inflation. Let’s not continue to reassess the economic growth on the system of the four apostles who were eventually three, Luke and Matthew (God forbid to be some global recession) and possibly just one of them.

We should be careful, even in the short term, about the evolution of the exchange rate. The amount of RON 924.2 billion representing the 2018 GDP, even accurately obtained, means EUR 201.3 billion at the forecasted exchange rate of 4.59 lei/euro, but it means only EUR 198.7 billion at the present value of 4.65 lei/euro where the foreign exchange market seems to have settled now.

The official average exchange rate announced was 4.6500 lei/euro for January and 4.6555 lei/euro for February. The average of 4.59 lei/euro for 2018, based on an equation of a middle school level, requires for an average of 4.5774 lei/euro in the remaining ten months until the end of the current year.

We are already, with an already weak target set at -2.97% of a GDP (questionable and placed at the denominator of the fraction) for the budget deficit. Therefore, any additional payment obligations can push us beyond the threshold of 3% of the alleged GDP to be achieved.

Therefore, it is pointless that we are far from the Maastricht unitary level set at 60% of GDP in terms of foreign debt, as we don’t have also the capacity to easily manage at least a level of 40%.