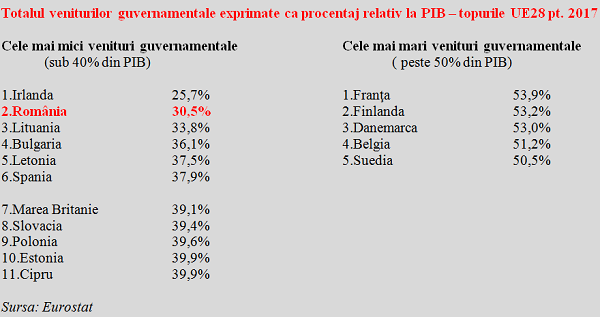

Last year, Romania was the EU country with the lowest public revenue related to GDP (30.5%), with the exception of Ireland (which was in a special situation due to the GDP over-estimation). According to data published by Eurostat, we are at a significant distance in this ad hoc top from the next countries, Lithuania (33.8%) and Bulgaria (36.1%).

Last year, Romania was the EU country with the lowest public revenue related to GDP (30.5%), with the exception of Ireland (which was in a special situation due to the GDP over-estimation). According to data published by Eurostat, we are at a significant distance in this ad hoc top from the next countries, Lithuania (33.8%) and Bulgaria (36.1%).

Besides, if we had amounts of money collected to the budget similar to them, we would have had no problems in meeting the budget deficit requirement of up to three percentage points of GDP. After a series of declines in revenues started in 2015, we should see only this year some return (RON 296.3 billion at a projected GDP of RON 945 billion, which is 31.3%, according to the most recent budget amendment).

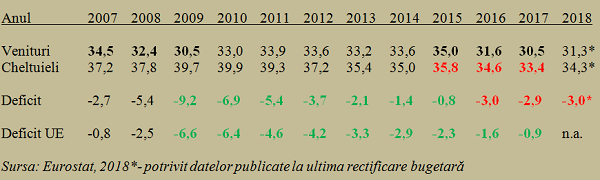

Incidentally, the 2007-2009 statistical series resembles in terms of share of revenues in GDP with the one between 2015 and 2017 and led to the same local minimum level, just above the critical threshold of 30%. A value that shows a state without solid means that would enable it to cover its social commitments and make absolutely necessary investments in infrastructure.

For reference, we present the rankings of European states by the revenue shares in GDP. Ireland was systematically positioned somewhere between 33% and 34% of GDP until three years ago when the relocation of some multinationals in view of Brexit and the reporting of their results obtained a relatively small economy artificially boosted GDP and reduced the share of public revenues in GDP.

*

- Total public revenues as a share of GDP – EU28 ranking in 2017

- Lowest public revenues (below 40% of GDP)

- Ireland

- Romania

- Lithuania

- Bulgaria

- Latvia

- Spain

- UK

- Slovakia

- Poland

- Estonia

- Cyprus

- Highest public revenues (more than 50% of GDP)

- France

- Finland

- Denmark

- Belgium

- Sweden

*

We can see how most European states are positioned by this key indicator for public finances at a level of at least 40% of GDP or immediately below that value.

At the opposite end, France is leading the ranking of the five developed Western states that have exceeded 50% of GDP, precisely in order to be able to carry out broad social policies based on the high level of economic development.

Anomalies and propaganda

As for the average levels of the budgets within EU 28, last year they were at 44.9% of GDP in revenue and 44.8% of GDP in expenditure, with a deficit of -0.9% of GDP.

We missed the opportunity to maintain an important budgetary balance requirement (the already well-known MTO or medium-term objective) met in 2015 following a model adjustment.

*

- Year

- Revenues

- Expenditure

- Deficit

- EU deficit

*

An adjustment made (note!) by increasing revenue collection to the highest level in the last ten years and limiting expenditure increases to the possibilities resulted from the economic growth.

It may seem paradoxical, but despite the intense media coverage on wage and pension increases, the share of budget expenditure in GDP has also declined since 2015, but less than the decline in revenue collection. It is noteworthy that the major separation between revenues, placed in terms of share of GDP at 68% of the EU average and expenditure, with 73% of the EU average.

Tax relief appears therefore as an economic policy error. Taking both left and right-wing measures at the same time does not mean that the result is a centre policy, but a bankrupting policy.

Data show that we use to exaggerate in either direction in terms of deficit and not notice the opportunities.

Considering how much the adjustment of public finances following the mistakes in 2008 cost us in terms of public debt, we should be more careful.

Expenditure cannot be committed toward 40% of GDP without fitting revenue

Having reached earlier close to a balance in public finances, we have uncoupled and went back to a maximum deficit. There is already foreseen in mid-term an attempt to bring public spending at a reasonable level at the European level (toward 40% of GDP, where they stayed between 2009 and 2011), but the source of funding is not envisaged at the (very low) proportion of the amounts collected to the state budget. In this context, the elementary logic also asks for a breakdown of the measures that can bring revenues also toward 40% of GDP.

It is only much simpler and more pleasant to plan substantially increased expenditure than to also plan the methods to tax the economy and citizens accordingly. Undertaking social policies on major budget deficits and public investment deficits denotes a lack of vision in the medium term and a lack of interest for future generations.

If we look at other countries in similar situations in terms of development level and with a relatively small revenue share in GDP, we find that they did not get to share from a source they did not collect. The proximate trio in the field had inexistent or minor deficits in 2017 and maintained their expenditure under certain limits even though they also have a low public debt. Lithuania (+0.5% of GDP) and Bulgaria (+ 0.9% of GDP) even had surpluses and Latvia recorded last year a deficit of only -0.5% of GDP.

On another level of revenue (toward 40% of GDP and above), the three foreign exchange regime colleagues from Central Europe were somewhat more indulgent in the public management but did not venture toward the 3% threshold and left room for manoeuvre for potential unforeseen problems (Poland and the Czech Republic -1.6% of GDP, budget deficit and Hungary 2% of GDP, but all with revenues of 40% of GDP collected).

On this trend, despite repeated warnings from specialists and international bodies, we are like nobody in terms of balancing the budget. As soon as we estimate a small increase in revenue, we rush into committing even higher expenditure. Therefore, there is no point in wondering whether it will happen to us what does not happen to others.