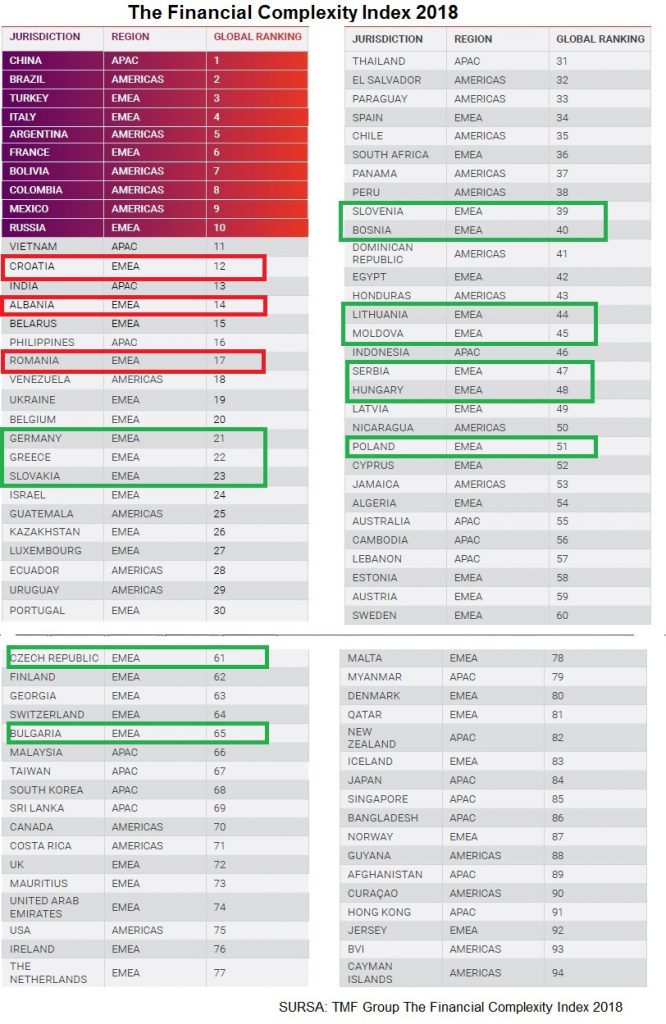

Businesses in Romania face the 18th world’s highest complexity of the accounting and tax systems.

Businesses in Romania face the 18th world’s highest complexity of the accounting and tax systems.

The complexity level of tax and accounting requirements in Romania went up 36 positions in one year in 2018 Financial Complexity Index, according to the assessment of the 2017 regulations in 94 countries.

Only Croatia (12th) and Albania (14th) are worse than Romania in the Central and Eastern Europe, if Turkey, Russia and Belarus are not included.

Ukraine, Bosnia and the Republic of Moldova are better!

All the countries with which we usually compare (those in the Central and Eastern Europe) are much better.

The study based on which the ranking has been made was conducted by TMF Group, one of the relevant global advisory providers having 7,000 experts in 83 countries.

Ranking relevance

The difficulty of doing business, or the (un)attractiveness of the business environment in a country, depends on the complexity of the tax and accounting regulations, according to the authors of the study.

On the other hand, countries with more advanced economies have developed more complex tax and accounting systems. However, difficulties are lower in Germany than in Romania.

Main analysis criteria

The ranking has been made by evaluating the answers to 74 questions addressed to TMF Group experts from these countries about the complexity of:

- Compliance with regulations (cross-border transactions, corporate representation, data storage)

- Taxes (registration, number and types of taxes)

- Reporting

- Accounting system (rules, relations with authorities and technology that supports them).

Details

The evaluation has also been made based on additional complexity parameters for each of the four main categories above:

- the frequency of legislative changes,

- number of rules and exceptions to their application,

- impact of technology on the accounting system.

- differences in instructions depending on authorities,

- accounting and tax regulations in relation to local GAAP (generally accepted accounting principles),

- reporting and audit requirements in local language and deadlines,

- VAT and income tax registration,

- risks associated with non-compliance,

Full ranking

Each of the four categories of criteria mentioned above contributed to the final complexity score by an average rating of:

- 61% – compliance (in the 2017 Index: 60%),

- 57% – reporting (55%)

- 49% – taxes (48%).

- 46% – accounting (51%).

Comparisons

All countries with which we usually compare are better and, besides them, many other countries in the region. Bulgaria has the simplest tax and accounting requirements. The regional complexity (difficulty) ranking continues with:

- Ukraine (19),

- Greece (22),

- Slovakia (23),

- Slovenia (39),

- Bosnia (40),

- Lithuania (44),

- Republic of Moldova (45),

- Serbia (47),

- Hungary (48),

- Latvia (49),

- Poland (51),

- Estonia (58),

- Austria (59),

- Czech Republic (61) and

- Bulgaria (65).

At the top of the list, countries with economies having authoritarian administration systems such as China (1) and Russia (10) are among the most difficult accounting and fiscal regimes.

Both Italy (4) and France (6) have problems, but precisely because of the delay in adapting their regulations to the evolution of their advanced economies.

Financial Complexity Index 2018

The study is at the second edition after its launching in 2017 and is dominated by the impact of the global trend in the need for transparency and compliance.

Many countries have reacted in the meantime to the OECD Basic Erosion and profit Shifting (BEPS) project, which means more transparency in relation to the ultimate beneficial owners (UBO) and transfer pricing.

Also, the Common Standard Reporting (CSR), designed to allow the automated exchange of information between jurisdictions through financial institutions, has started to produce an impact.

„Countries are as unique as ever and each of them addresses these global issues in a different way, which has led to the current configuration of this ranking,” mentions the study.