The first step for establishing the Sovereign Fund for Development and Investment has been made Wednesday when the Official Gazette published Grindeanu government’s decision to create the inter-ministerial committee that will draft the legal framework for the establishment and operation of FSDI.

The first step for establishing the Sovereign Fund for Development and Investment has been made Wednesday when the Official Gazette published Grindeanu government’s decision to create the inter-ministerial committee that will draft the legal framework for the establishment and operation of FSDI.

A note should be made: the initiative has a great significance for Romania’s big partner institutions, as IMF and EBRD delegations visited the Government in March, to get details and provide their expertise in establishing the fund.

The fundamental problem that the PSD’s initiative raises is that the institution’s future decisions could be influenced politically – which is unacceptable in the consolidated economies.

Additionally: the decision to create FSDI occurs at a time when the Government decided to obtain more money for the budget from the state companies in the form of dividends. Some of these state-owned companies would be included in the FSDI portfolio, but with a diminished „heritage” that will directly affect the investment programs of the Fund.

The commission called upon to work on the FSDI related legislation comprises representatives of the ministries of Economy, Finance, Energy and Ministry of Labour and Social Justice, plus a direct representative of the Prime Minister.

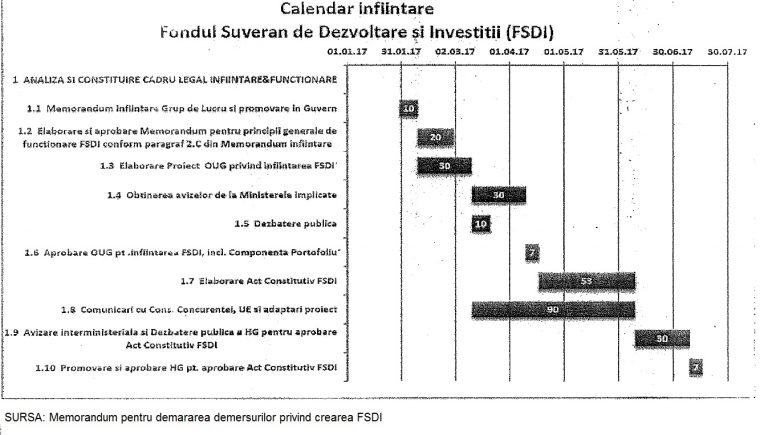

The Government, which has not yet provided any fundamental details on this project, is lagging behind the plan proposed in February when it approved the memorandum for establishing the FSDI.

*

- FDSI establishment timetable

*

According to the Government’s own commitment, the draft emergency ordinance for establishing the FSDI should have been ready last month, the draft that would also contain „the general principles of its operation.”

The opinions of the ministries involved should be obtained no later than Friday if the Government wants to keep the calendar announced two months ago.

Fund identity issues added to the biggest problem: source of trust

The project of the Sovereign Fund for Development and Investment (FSDI) has two major identity issues:

- what kind of sovereign fund will be

- how it will attain its objectives, as an entity that will operate on the international markets

FSDI needs to gain confidence and a favourable negotiation status on the financial markets, especially that it is provided its investment financing by issuing bonds, of corporate type probably.

The trust that FSDI is to gain depends on:

- the transparency on how FSDI is built and its investment strategy is set, and

- ensuring a professional management and a supervision not affected by parasitic political interferences

The idea of a sovereign fund „may be good, but needs to have a clear purpose, such as the infrastructure investments,” said recently Matteo Patrone, the head of the European Bank for Reconstruction and Development (EBRD) for Romania and Bulgaria.

„In Romania, not money is the problem when it comes to investment in infrastructure, but the capacity to design projects and the implementation of public procurement„, explained the EBRD official, after having carefully studied the details about the fund from the Romanian Government’s program.

Clues from government program

How FSDI will be positioned on the market, where it will fight very efficient institutional structures for gaining the trust of the largest financial resources suppliers of the world?

The government program does not indicate any clear orientation of the FSDI, but towards a mixed type of fund, positioned somewhere between the model aimed at developing the infrastructure and a model aimed at obtaining profits as high as possible in the medium term, rather inspired by the private equity investment practice.

The government program promises:

- „establishment of numerous factories in agriculture and industry”, and

- capitalization of several already existing large companies

Many of the state’s holdings in these companies are to be sold, at least partially, so that the fund’s investment resources to be restored and increase, to approach new projects.

On the other hand, FSDI will have strong attributes of a socio-economic development fund that will be even more difficult to aggregate within the management strategy of the Fund.

Such recipes are similar to some sovereign funds that are not the champions of transparency, such as those from Abu Dhabi and Iran, precisely because the government policies decisively influence the management of these funds.

„The biggest FSDI investment in the next four years will be made in the healthcare field, in building a republican hospital and eight regional hospitals”, mentions the government program.

What international experience says?

„Santiago Principles”

To avoid damaging distortions on world markets, the governments of 26 member states of the International Monetary Fund, which have sovereign funds, agreed since 2008 to comply with certain principles of organization, activity and behaviour on the market.

This is how the „Santiago Principles” appeared, structured on three main categories:

- legal framework, objectives and coordination with the sound macroeconomic policies;

- institutional framework and governance structure;

- investment and risk management.

FSDI has to do with all three types of principles and must fill many information gaps and convincingly reconcile many of suspicions that accompanied, for many years already, the alike initiatives from Romania.

„A sound governance structure that separates the functions of the owner (the Fund – editor’s note), the governing bodies and the operational management facilitates the independence in the fund management, with the aim to ensure an investment decision making and management operations free of any political influence,” says the document of the IWG working group which drafted the Santiago Principles on the sovereign wealth funds, under the IMF aegis.

The IWG document promotes plans and clear and disciplined investment practices, the responsibility and soundness of the risk management and investment operations.

Irrespective of the model and structure that the FSDI will adopt, they „must ensure the adequate and effective separation of the supervision and decision-making (functions) and the operational responsibilities,” in line with the Santiago Principles.

Types of structure

Some of the world’s sovereign wealth funds are set up as separate legal entities, with a governance structure that clearly differentiates between the owner (the state entity that officially owns the fund), the supervisory body and the management entity.

This is how the sovereign funds from Singapore, Australia, one of China’s sovereign wealth fund, the funds from Qatar and the United Arab Emirates function, according to the IWG document.

Another situation is when a fund consists of assets without separate legal personality (such as the revenues from the exploitation of raw materials), in which case the owner may exercise the supervisory function (a ministry or a parliamentary committee). In this case, it is still clear the separation from the management entity.

This is the case of the funds from Chile, Canada (Alberta Fund), Mexico, Norway, Russia, and Trinidad and Tobago. The management may be entrusted to the central bank, as in Chile and Norway, or an agency with separate legal status, as for the Alberta Fund.

A relatively complicated network of connections is established between the official owner, the supervisory body and the fund manager, to comply with the fund’s objectives and more precisely the rigorous and profitable management of the public funds, whatever their source.

Types of funds, by their purpose

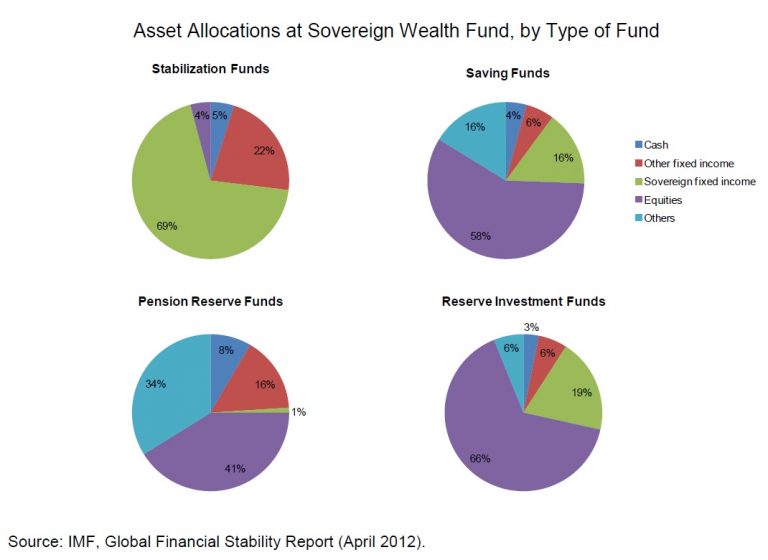

There are four main types of sovereign wealth funds, depending on the purpose for which the governments have established them and therefore the type of investments and activities that they undertake.

Stability funds are set up to save the national budgets and economies of those countries from the fluctuations of the commodity prices, the market volatility and the external shocks.

Stability funds are set up to save the national budgets and economies of those countries from the fluctuations of the commodity prices, the market volatility and the external shocks.

„Their liquidity targets and investment time horizons are comparable to those of the managers in charge of the central banks reserves, given the role of investments in the countercyclical fiscal policies, needed to curb or further stimulate the economic growth rate – according to a IMF’s working document from 2013 on „The sovereign wealth funds: Issues of governance structures and investment management.”

Stability funds hold large shares of highly liquid fixed income instruments, mostly government bonds highly rated on the world markets. Examples: the funds of Chile (Economic and Social Stabilization Fund), Iran and Russia (Oil Stabilization Fund).

Savings funds are aimed at the profitable preserving of the wealth for future generations by changing the non-renewable assets into a portfolio of diversified assets.

These are funds that prefer the high-yield investments, with corresponding risks attached, such as the funds Abu Dhabi Investment Authority, those from Libya and Russia (National Wealth Fund).

Pension reserve funds are established to cover future payment obligations, under certain evolution of budget revenues. They invest in shares of large and financially strong companies and other instruments to compensate the increased the increase of the amounts needed to pay pensions. Common examples are the funds from Australia, Ireland and New Zealand.

There are not excluded, though, the cases when a fund undertakes purposes specific to different typologies, which makes the management as more difficult, as the goals are more diverse.

Based on the types of resource allocation mentioned above, there are models of development funds or reserve hybrid funds.

The first aim to allocate resources to finance socio-economic projects, usually in infrastructure, as it is the case in the United Arab Emirates and Iran (National Development Fund). In this case, balancing different types of investments becomes essential for the resources to refresh.

There are also reserve investment funds aimed at reducing the costs of holding reserves, and large gains on the account of such reserves while maintaining their specific status (the case of some sovereign funds in China, South Korea or Singapore). In this case, managers allocate high percentages to listed shares (50% in the South Korean fund, or 75% in Singapore Government Investment Corporation), says the IMF’s document.

cursdeguvernare.ro will offer further details as Romania’s Sovereign Fund will become more clearly organized.

Who will manage FSDI

The only details about the identity of the Romanian Sovereign Fund for Development and Investment (FSDI) are those very general and ambitious from Grindeanu government program and the Memorandum on establishing the Fund. This latter document has been recently approved by the Government and adds a list of the important steps for establishing the fund and the idea of financing through own bond issue.

The investment management could be ensured, in the case of the Romanian FSDI, by „a steering committee with members elected through a public selection„, according to a statement made by the Minister of Economy when the Government approved the Memorandum mentioned.

Although made by Minister Alexandru Petrescu „from a personal perspective,” the statement expressed an idea that circulates through the official circles. In the meantime, Alexandru Petrescu has been transferred to the Ministry for Business Environment.

„It remains for us to find the best formula in the instruments of incorporation,” also said the official, noting that „the instruments of incorporation and how the Fund will function and be structured” will guarantee the professionalism of the FSDI’s management.

The actual establishment of FSDI will happen after a government decision will approve the Fund’s instruments of incorporation, sometime in mid-July, according to the timetable set by the Memorandum.

Questions and needs

„Who is supposed to select the investments (FDSI, editor’s note) to avoid having a fund for aircraft, railway wagons and nuclear reactors, as shown in the government program?”, asks the analyst Cristian Tudorescu, in an analysis published on cursdeguvernare.ro.

Another question is about the type of management needed for FSDI, so it does not turn into an „unfortunate choice„. The management of the Sovereign Fund would risk becoming „a new bureaucratic structure” to distribute billions of euros obtained from dividends and project bonds, based on performance criteria that mix the social with the investment performance.

„For that, we do not need some sovereign fund, and if it is to be limited to this objective (to wait for the dividend payments, editor’s note), then the Fund project should be stopped in the bud because it does not justify its existence and efficiency” considers the analyst.

FDSI “represents an interesting and ambitious plan, and if properly implemented, it could really bring added value to Romania, the Romanian economy, and companies owned by the Romanian state and Fondul Proprietatea, as their shareholder,”– recently said Greg Konieczny, manager of Fondul Proprietatea (FP).

It is no coincidence that he recently joined the public debate on FSDI, saying that the Fund needs:

- „a clear separation between the management function in the state companies and the creation of government policies”;

- „more transparency on what it happens with the state companies”.

Fondul Proprietatea (FP) has its own interests that coincide to some extent with the interests of the large state companies in which it holds significant stakes and which are also likely to enter the FSDI portfolio.

Both funds are interested in the profitability of certain companies such as Hidroelectrica, Nuclearelectrica, Conpet, Salrom, CN Posta Romana.

The FP head said that the private interests related to FSDI are not be neglected, especially when it comes to listing the companies from the portfolio of the future fund and especially given that, for instance, Hidroelectrica’s listing can barely be predictable for this year, according to the statements made by Greg Konieczny.

FP is managed by a subsidiary of Franklin Templeton Inc., one of the most influential private investment management corporations in the world that manages assets of over 650 billion dollars, including more than four billions in Fondul Proprietatea.